4 Supply Chain Challenges in Electronics Manufacturing

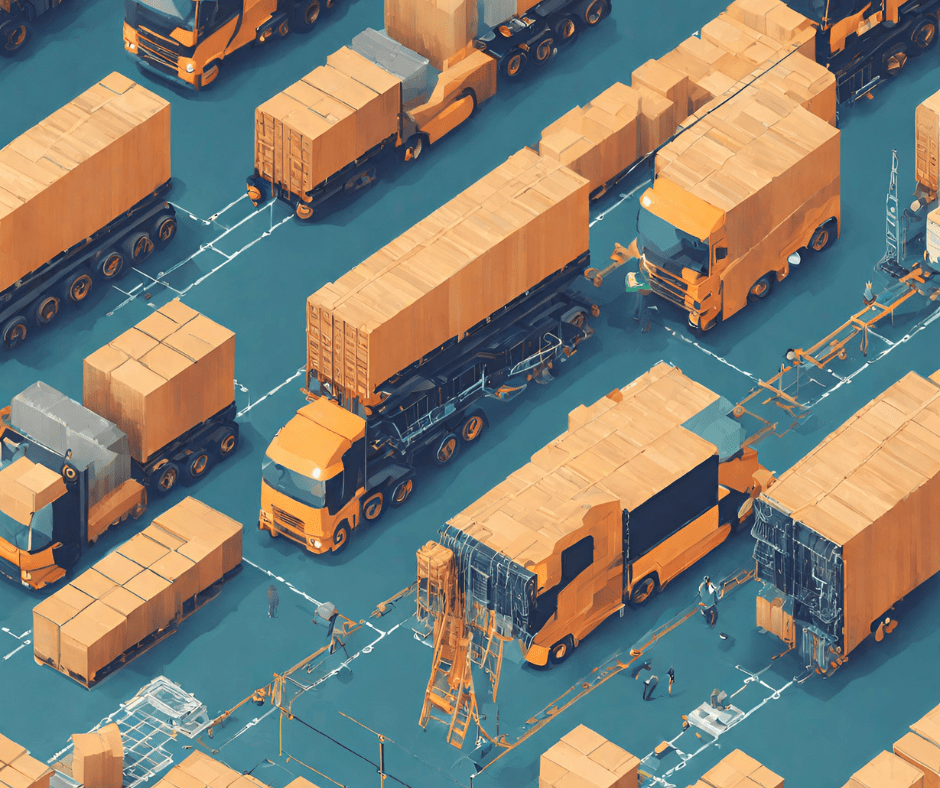

The landscape of electronics manufacturing is evolving at a rapid pace, driven by technological advancements, changing consumer preferences, and global market dynamics. As electronics manufacturers and OEMs confront the challenges of the future, they must reimagine their supply chain strategies to stay competitive and resilient. In this blog, we’ll explore 4 key supply chain challenges […]

Navigating the Electronic Component Landscape: Top 50 Parts

In the rapidly evolving world of technology, electronic components serve as the backbone, powering various devices and systems. As we anticipate the trends of 2024, the significance of these components is poised to grow even further. For both excess buyers and sellers, understanding the demand dynamics is crucial to staying competitive in the market. Fortunately, […]

Maximizing Efficiency: 3 Purchasing Strategies Empowered by iBuyXS and BidChips for Electronic Component Buyers

In the world of electronic component procurement, efficiency is paramount. The constant demand for innovation, coupled with the complexities of global supply chains, presents a challenge for buyers to do more with less. However, with the right purchasing strategies and innovative platforms like iBuyXS and BidChips, electronic component buyers can navigate these challenges effectively. Let’s […]

B2B Guide: The Most Sought-After Electronic Components

Our curated Top 50 list reveals the most sought-after components in the electronics industry. Discover what’s fueling demand and stay ahead of the curve.

Navigating Supply Chain Disruption After Taiwan Earthquake

Explore the impact of the recent Taiwan earthquake on the supply chain of electronic components and strategies to navigate through the disruption.

Essential Guide: Top 50 Electronic Components

Overview of Electronic Components for OEMs The increasing demand for electronic components is propelled by technological advancements and the expansion of the consumer market. It is imperative to stay current with these trends. Here, we present the top 50 sought-after components, which are crucial for original equipment manufacturers (OEM) and EMS companies engaged in the […]

Navigating the Maze in the Electronic Component Supply Chain

Unlock real-time insights and access a diverse supplier network for efficient sourcing of excess electronic components amid uncertainty

This Week’s Top 50 in Disti: How We Secure the Hardest-to-Find Chips for You

Explore our curated list of top 50 distributed electronic components, sourced to meet your needs. Find the hardest-to-find chips secured just for you.

2024 Tech Tsunami: Navigating the Electronic Component Glut

Stay ahead in 2024’s dynamic tech landscape. Expert guidance for navigating the electronic component glut.

Sell Electronic Components and Free Up Cash Flow for 2024

Free up cash flow with iBuyXS: Learn how we make selling your electronic components easy. Receive quick quotes and rapid payments!